In Brief

Define or update your ideal customer profile (ICP) to increase understanding of the most valuable customers, and focus on prospects with similar traits and behaviors.

Enrich account data to refine the ICP, building a model that scores each account and predicts which ones will have the highest lifetime value.

Use the ICP to assess territory assignments, improve sales plays and marketing campaigns, focus reps on high-value prospects, and better allocate resources.

As enterprise software companies adapt to the macro environment, sales leaders are being asked to do more with less and increase their productivity. For many, this has meant a more focused approach on proven use cases by ensuring that sales & marketing efforts are allocated to the prospects with the highest potential lifetime value (LTV). While most companies prioritize their prospects, it might be time to dust off the approach, efficacy, and governance to ensure that they are grounded in a company’s Ideal Customer Profile (ICP).

The ICP is defined by a set of characteristics attributed to a company’s most valuable customers with the highest LTV. The ICP is a sub-set of your Total Addressable Market (TAM), prospect list, and your target customer. Having a clear and thoughtful definition of the ICP along with their journey can inform an entire sales and marketing strategy, organizational design, and tactics such as content creation, messaging, and pitch decks.

Quantitative Signals

- Win rate

- Duration as a customer

- High Net Promoter Score (NPS)

- High Annual Contract Value (ACV)

- Expansion via upsell / cross sells

Defining the ICP attributes can vary in complexity based on the maturity of the business. In most cases, a data driven approach can provide the insight to inform the variables that matter the most. This starts with enriching the customer and prospect list with some of the most common attributes that could include:

ICP Attributes

Firmographic data

- Industry

- Segment and size of company

- Geography

Business strength data

- Profitability

- Funding data

- FTE growth

- Budget

Value prop specific data

Examples include:

- # of employees at a company

- Certain tools or vendors at a company

While Rev Ops would typically manage and analyze these attributes, Sales & Marketing executive leadership should own the cross functional effort to establish the ICP and hold an initial workshop to identify the attributes to test.

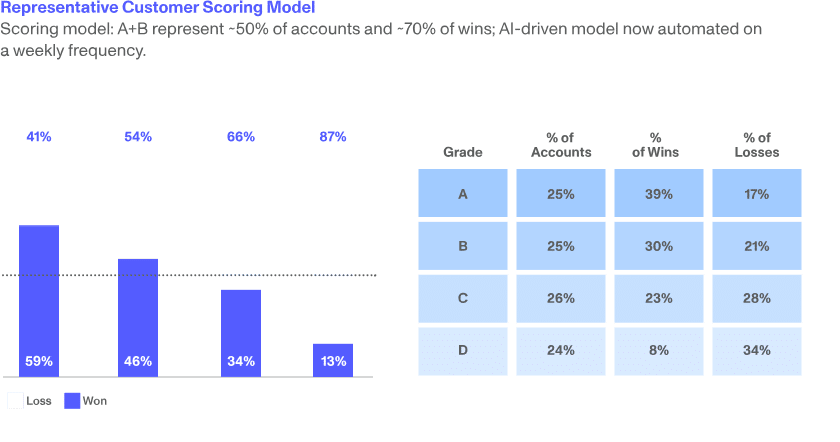

The data can often take time to capture and centralize, so it may be wise to have an iterative approach as all the data gets consolidated. From there the data can be continuously analyzed, and if applicable, a training model be built to define the cohorts and micro-segments of customers that make up the ICP. The training model could include all the attributes defining valuable customers (the ICP attributes) as well as historical sales, marketing, and customer success activity (e.g., win loss data, lead generation and customer adoption). Ultimately, the model should be able to predict prospects with the highest potential LTV and assign a score/tier to each one.

One of our portfolio companies was able to identify that their ICP has a win rate of 39%, which is ~170%-490% higher than those of their least valuable customers. As a result, they refocused their prospecting efforts to maximize their win rate.

At another one of our portfolio companies that was selling into a consolidated buyer market, we found that the existing customer scoring methodology was effective in identifying new opportunities, but was not leading us to opportunities that we could close.

After doing a retrospective analysis and refreshing the scoring methodology, we refocused sellers’ time on deals most likely to close and that enabled us to beat bookings plan by 30% in subsequent quarters.

Implementation and governance of what a company does with this information should be viewed with a strategic vs tactical lens. Armed with this data, Rev Ops can have a much more targeted perspective on everything it does in supporting sales & marketing leadership. Examples of this include:

- Enhancing how territories are assigned. Assigning ICP scores to customers and prospects in each territory can add a layer of insight to see how balanced the territories are as well as the need for any industry specialization.

- Informing sales plays: Based on the cohorts or micro-segments identified, marketing & sales can partner on targeted campaigns to determine which plays have been more successful with the ICP.

- Monitoring of pipeline: Pipeline in aggregate as well as for each rep can be monitored to ensure efforts are placed on accounts with the highest potential win rate and LTV. In some cases, requiring sign-off to pursue prospects outside the ICP can be an effective governance mechanism.

- Measuring productivity across segments: Sales and marketing resource allocation (headcount by role and spend) can be combined with ICP data to reveal how productive efforts are in the places that matter the most. Companies can also measure productivity or “magic number” by segment and geography to cross-reference with pipeline and deals won coming from ICP vs non-ICP prospects.

- Re-validating ICP adherence of your existing customer base: Over time, acquired customers might no longer match with an evolving ICP model and provide lower LTV than expected. It might be worthwhile to carefully review your customer base and, in some cases, proactively deprioritize accounts if they do not perform as expected.

A focused approach to GTM can yield more consistency in meeting sales targets and can improve a variety of metrics including win rates, customer acquisition cost (CAC), LTV, and sales cycles. By tracking and discussing ICP scores within a sales pipeline, companies can often improve their win rates. In practice, the governance and implementation of these ideas has gaps that appear over time. It is wise to revisit the details of how your company defines the ICP and how focused the organization is on the ICP by mapping the resources allocated to these efforts.