Investment Strategy

Discovering untapped potential

We seek out potential across our five core sectors, finding opportunities to raise the bar, drive change built to last, and achieve sustained growth.

Building differentiated businesses over time

We are a leading global private equity firm, and as part of our process we take a rigorous approach to due diligence and identify businesses where we can partner closely with leadership teams. Our ecosystem of curated resources helps portfolio companies achieve their complex goals.

A dynamic investment approach

We prioritize flexibility when investing, enabling us to pursue compelling prospects across various transaction types – from equity deals and leveraged buyouts to complex carve-outs and public-to-privates.

Providing wide-ranging expertise

We serve as active listeners when engaging with our management teams to ensure we are equipped to support their business priorities. Our network of industry experts and extensive worldwide resources, which includes our Portfolio Support Group, Operating Partners, and Operations Advisors, allows us to dig deep into businesses and collaboratively develop value creation plans.

Prioritizing accountability

As responsible investors, we look for unique ways to build world-class businesses. Across each investment, we remain focused on furthering our commitment to governance and environmental best practices, as well as doing good in the communities in which we operate.

“Working closely with our management teams to create lasting value is one of the things of which we are most proud. We work hard to build companies that are successful long after their tenure with Advent.”

David Mussafer

Managing Partner, Advent

CONVENING IDEAS AND INSIGHTS

We believe in the flywheel effect and are continuously bringing our community together to generate the most innovative ideas, drive transformation, and leverage our collective capabilities.

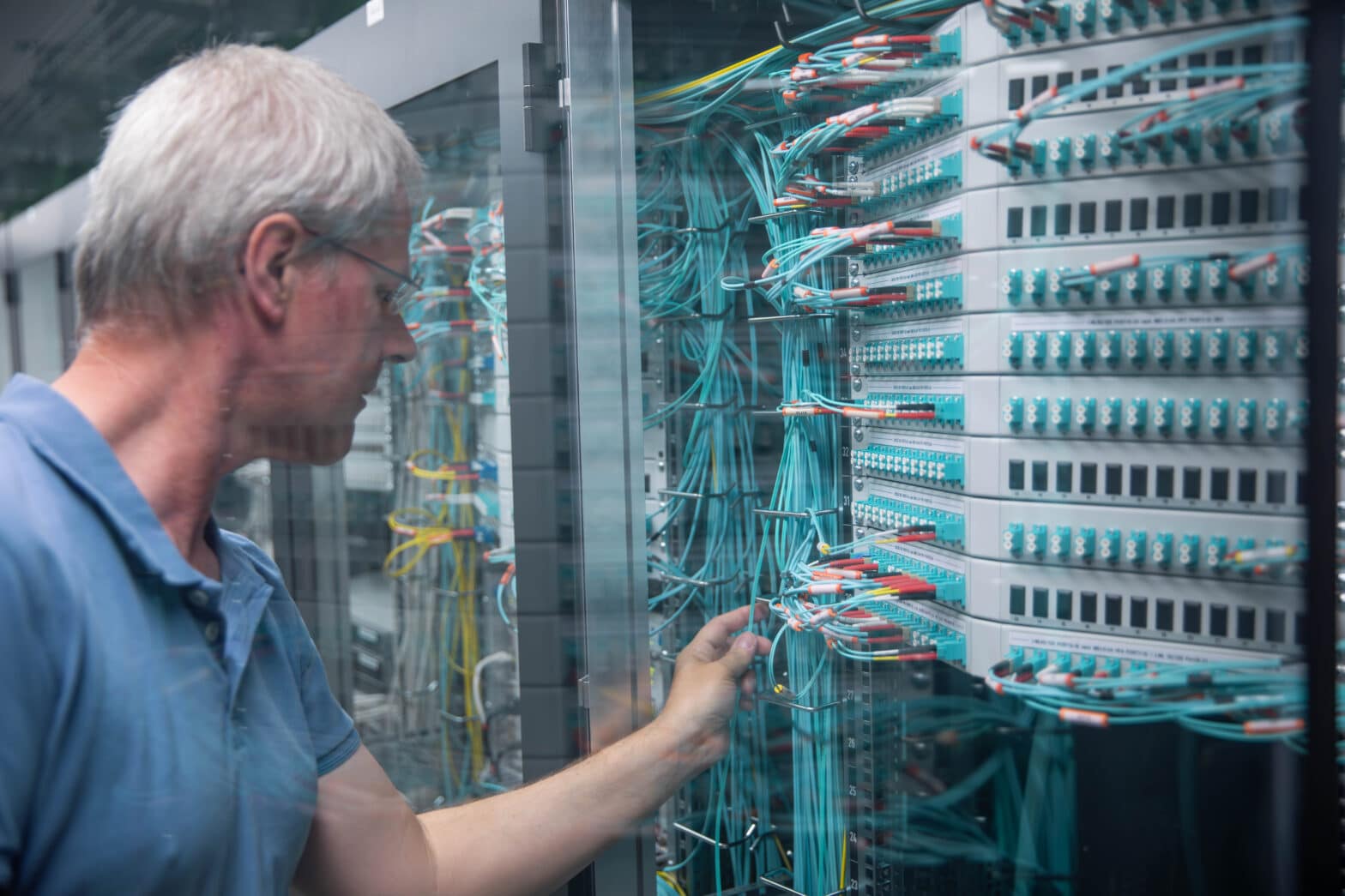

Our core sectors

We’ve cultivated decades of deep knowledge in five sectors.

Our extensive expertise in sub-sectors such as payments, cybersecurity, chemicals, luxury goods and beauty, pharmaceuticals, and more allows us to provide valuable insights, trend analysis, and innovative approaches to support the goals of our portfolio companies.

Investing with a global view

Growth at scale requires local and global know-how. With people on the ground in 16 offices in 13 countries across five continents, we believe we’re ideally positioned to help our partners succeed in domestic and global markets alike.