August 7, 2023: CAMDEN, N.J. & LOUISVILLE, Colo.–(BUSINESS WIRE)–Campbell Soup Company (NYSE: CPB) and Sovos Brands, Inc. (Nasdaq: SOVO) today announced that the companies have entered into an agreement for Campbell to acquire Sovos Brands, Inc. for $23 per share in cash, representing a total enterprise value of approximately $2.7 billion. This represents a 14.6x adjusted EBITDA multiple1 including expected annual run rate synergies of approximately $50 million. The strategic transaction adds a high-growth, market-leading premium portfolio of brands to diversify and enhance Campbell’s Meals & Beverages division, providing a substantial runway for sustained profitable growth.

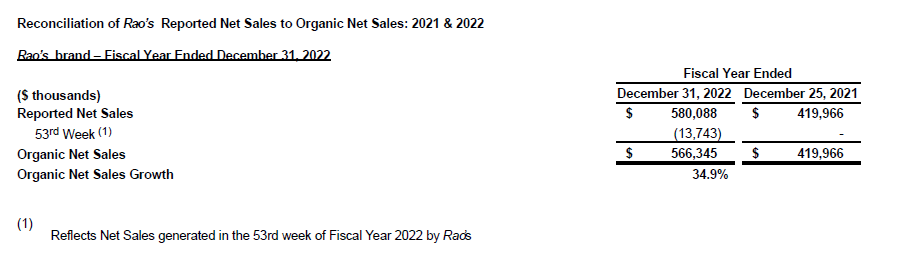

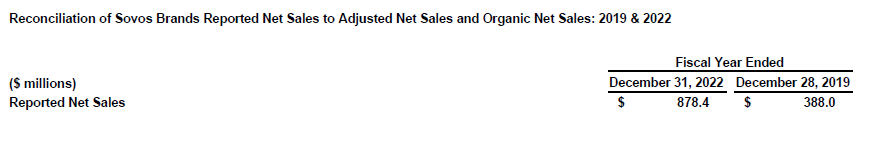

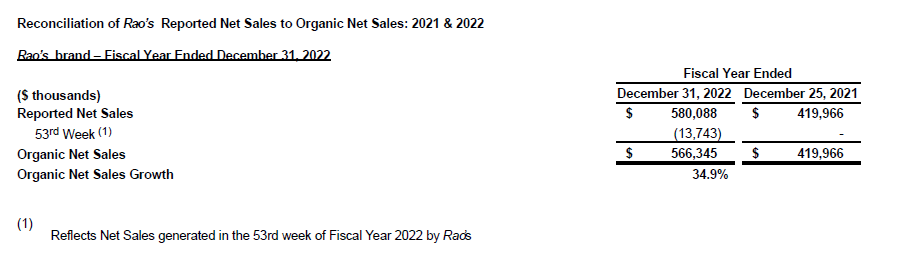

Sovos Brands had annual adjusted net sales of $8372 million in calendar year 2022 and is a compelling growth story as a North America focused food company with compounded annual organic net sales growth rate of 28%3 from fiscal 2019 to fiscal 2022 offering a variety of premium products including pasta sauces, dry pasta, soups, frozen entrées, frozen pizza and yogurts under the brand names Rao’s , Michael Angelo’s and noosa. The flagship Rao’s brand, which represented approximately 69%4 of Sovos Brands adjusted net sales in fiscal 2022, grew organic net sales by 34.9%5 compared to the prior year.

“We’re thrilled to add the most compelling growth story in the food industry and welcome the talented employees who have built a nearly $1 billion portfolio,” said Campbell’s President and CEO Mark Clouse. “This acquisition fits perfectly with and accelerates our strategy of focusing on one geography, two divisions and select key categories that we know well. Our focused strategy has enabled us to deliver strong results over the last five years, enhance our brands and capabilities, and generate strong cash flow to lower debt. With all this progress, I am confident in our readiness to execute and integrate this important acquisition. The Sovos Brands portfolio strengthens and diversifies our Meals & Beverages division and paired with our faster-growing and differentiated Snacks division, makes Campbell one of the most dependable, growth-oriented names in food.”

“Today marks a momentous occasion for Sovos Brands as we announce our plans to join the Campbell’s family,” commented Todd Lachman, Founder, President and Chief Executive Officer of Sovos Brands, Inc. “We have built a one-of-a-kind, high growth food company focused on taste-led products across a portfolio of premium brands, anchored by the Rao’s brand. Our success would not have been possible without the incredibly talented and passionate team at Sovos Brands, which has been instrumental in building one of the fastest growing food companies of scale in the industry today. This transaction is expected to create substantial value for our shareholders, resulting in a 92% increase from our 2021 IPO price. As one of the most trusted and respected food companies in North America, I’m confident in Campbell’s ability to continue bringing our products to more households and further building on our track record of growth and success for years to come.”

Compelling Strategic Rationale

Multi-dimensional Value Creation

- Acquisition unlocks significant value through strong and sustainable growth opportunities

- Expect a fast, effective and efficient integration and synergy unlock given familiarity with categories and Campbell’s strong capabilities, processes and proven integration playbook

- The acquisition is expected to provide considerable earnings growth contribution to the division while unlocking

additional value through meaningful cost synergies

- Campbell’s supply chain excellence and scale are expected to drive operating synergies for Sovos Brands, while

improving scale efficiency of Campbell’s core operations

Attractive Sustainable Profitable Growth

- Significant whitespace opportunity for Rao’s and Michael Angelo’s through increased distribution, growing items per store and household penetration to category peer levels

- Campbell’s expertise in retail execution is expected to enhance shelf productivity, geographic footprint, and

sub-category penetration

- Sovos Brands’ expertise in innovation, category expansion and the marketing of high-growth brands is expected to enhance and strengthen Campbell’s capabilities as the portfolio continues to transform

Accelerates Campbell’s Focused, Strategic Plan

- Further advances the company’s focused one geography, two division roadmap – Meals & Beverages and Snacks

- Solidifies role of Meals & Beverages as a sustainable and dependable contributor to the enterprise, by

complementing a stable, core portfolio in mainstream product categories with a fast-growing differentiated, premium

segment

- Delivers Campbell’s $1 billion sauces strategic objective by filling in critical white space in the growing ultradistinctive Italian sauce category, a segment where Campbell’s does not currently compete

- Extends Campbell’s presence into the fast growing, on-trend, premium frozen meals segment with Rao’s and

Michael Angelo’s , while adding meaningful scale to the existing Pepperidge Farm’s frozen portfolio

Financial Highlights

The all-cash offer for Sovos Brands of $23 per share for a total enterprise value of approximately $2.7 billion represents an adjusted EBITDA multiple of 14.6x including run rate synergies and 19.8x excluding synergies6. The acquisition is expected to support Campbell’s long-term financial growth algorithm with expected annualized cost synergies reaching approximately $50 million over the next two years, applying the learnings from the successful integrations of Snyder’s-Lance and Pacific Foods. The transaction is expected to be accretive to adjusted diluted earnings per share by the second year, excluding one-time integration expenses and costs to achieve synergies.

Following the completion of the transaction, Sovos Brands’ results will be managed within Campbell’s Meals & Beverage division.

Transaction Structure and Timing

Campbell plans to finance the acquisition price through the issuance of new debt. Projected leverage is expected to be approximately 4x7 at closing. Given Campbell’s expectation of continued strong cash flow from operations, the company remains committed to maintaining its capital allocation priorities that include continued investment in key growth and productivity initiatives in the business, maintaining a competitive dividend, a focus on reaching our target leverage ratio of approximately 3x by the end of the third year, and continuing anti-dilutive share repurchases.

The closing of the transaction is subject to Sovos Brands stockholder approval and customary closing conditions, including regulatory approvals. Closing is expected by the end of December 2023. The transaction has been approved by both Boards of Directors. In addition, each member of the Board of Directors of Sovos Brands that is a stockholder of Sovos Brands and certain funds affiliated with Advent International that are stockholders of Sovos Brands have entered into voting agreements with Campbell, pursuant to which each has agreed, among other things, to support the transaction.

Evercore acted as Campbell’s lead financial advisor in this transaction. Davis Polk & Wardwell LLP acted as Campbell’s legal counsel. Goldman Sachs & Co. LLC and Centerview Partners LLC acted as financial advisors to Sovos Brands, and Hogan Lovells US LLP and Richards, Layton & Finger, P.A. acted as legal counsel. Weil, Gotshal & Manges LLP acted as Advent International’s legal counsel.

Transaction Conference Call and Webcast

Campbell’s management team will host a conference call to discuss the acquisition announcement today at 8:00 a.m. EST. Participants calling from the U.S. may dial in using the toll-free phone number (888) 210-3346. Participants calling from outside the U.S. may dial in using phone number (646) 960-0253. The conference access code is 2518868. Additionally, access to a live listen-only audio webcast is available at the following link: https://events.q4inc.com/attendee/701780401. The accompanying slide presentation, as well as a replay of the webcast, will be available at investor.campbellsoupcompany.com/events-and-presentations.

About Campbell

For more than 150 years, Campbell (NYSE: CPB) has been connecting people through food they love. Generations of consumers have trusted Campbell to provide delicious and affordable food and beverages. Headquartered in Camden, N.J. since 1869, Campbell generated fiscal 2022 net sales of $8.6 billion. Our portfolio includes iconic brands such as Campbell’s, Cape Cod, Goldfish, Kettle Brand, Lance , Late July, Milano, Pace, Pacific Foods, Pepperidge Farm, Prego, Snyder’s of Hanover, Swanson and V8. Campbell has a heritage of giving back and acting as a good steward of the environment. The company is a member of the Standard & Poor’s 500 as well as the FTSE4Good and Bloomberg Gender-Equality Indices. For more information, visit www.campbellsoupcompany.com or follow company news on Twitter via @CampbellSoupCo.

About Sovos Brands, Inc.

Sovos Brands, Inc. is a consumer-packaged food company focused on acquiring and building disruptive growth brands that bring today’s consumers great tasting food that fits the way they live. The company’s product offerings include a variety of pasta sauces, dry pasta, soups, frozen entrées, frozen pizza and yogurts, all of which are sold in North America under the brand names Rao’s, Michael Angelo’s and noosa. All Sovos Brands’ products are built with authenticity at their core, providing consumers with one-of-a-kind food experiences that are genuine, delicious, and unforgettable. The company is headquartered in Louisville, Colorado. For more information on Sovos Brands and its products, please visit www.sovosbrands.com.

Additional Information For Sovos Brands, Inc. Shareholders and Where to Find It

This press release does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This press release relates to a proposed acquisition of Sovos Brands, Inc. (”Sovos Brands”) by Campbell Soup Company (“Campbell”). In connection with this transaction, Sovos Brands will file relevant materials with the Securities and Exchange Commission (the “SEC”). INVESTORS AND SECURITY HOLDERS OF SOVOS BRANDS ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (when available) will be mailed to stockholders of Sovos Brands. Investors and security holders will be able to obtain free copies of these documents (when available) and other documents filed with the SEC by Sovos Brands through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Sovos Brands will be available free of charge on the Sovos Brands’ website at https://sovosbrands.com or by contacting Sovos Brands by email at IR@sovosbrands.com or by mail at 168 Centennial Parkway, Suite 200, Louisville, CO 80027.

Participants in the Solicitation

Sovos Brands, its directors and certain of its executive officers may be considered participants in the solicitation of proxies from the Sovos Brands’stockholders in connection with the proposed transaction. Information about the directors and executive officers of Sovos Brands is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 8, 2023, its Proxy Statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 27, 2023, its Quarterly Report on Form 10-Q for the quarter ended April 1, 2023, which was filed with the SEC on May 10, 2023, and in other documents filed with the SEC by Sovos Brands and its officers and directors.

These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials in connection with the transaction to be filed with the SEC when they become available.

Forward-Looking Statements

Certain statements in this press release regarding the proposed transaction, including any statements regarding the expected timetable for completing the proposed transaction, benefits of the proposed transaction, future opportunities, future financial performance and any other statements regarding future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “aim,” “anticipate,” “believe,” “could,” “ensure,” “estimate,” “expect,” “forecasts,” “if,” “intend,” “likely” “may,” “might,” “outlook,” “plan,” “positioned,” “potential,” “predict,” “probable,” “project,” “should,” “strategy,” “target,” “will,” “would,” and similar expressions, and the negative thereof, are intended to identify forward-looking statements.

All forward-looking information is subject to numerous risks and uncertainties, many of which are beyond the control of Sovos Brands or Campbell, that could cause actual results to:

-

- the conditions to the completion of the Sovos Brands transaction, including obtaining Sovos Brands stockholder approval, may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected, on the anticipated schedule, or at all;

- long-term financing for the Sovos Brands transaction may not be obtained by Campbell on favorable terms, or at all;

- closing of the Sovos Brands transaction may not occur or be delayed, either as a result of litigation related to the transaction or otherwise or result in significant costs of defense, indemnification and liability;

- the risk that the cost savings and any other synergies from the Sovos Brands transaction may not be fully realized by Campbell or may take longer or cost more to be realized than expected, including that the Sovos Brands transaction may not be accretive to Campbell within the expected timeframe or the extent anticipated

- completing the Sovos Brands transaction may distract Campbell’s management from other important matters;

- the risks related to the availability of, and cost inflation in, supply chain inputs, including labor, raw materials, commodities, packaging and transportation;

- Campbell’s ability to execute on and realize the expected benefits from its strategy, including growing sales in snacks and growing/maintaining its market share position in soup;

- the impact of strong competitive responses to Campbell’s efforts to leverage its brand power with product innovation, promotional programs and new advertising; the risks associated with trade and consumer acceptance of product improvements, shelving initiatives, new products and pricing and promotional strategies;

- the ability to realize projected cost savings and benefits from cost savings initiatives and the integration of recent acquisitions;

- disruptions in or inefficiencies to Campbell’s or Sovos Brands’ supply chain and/or operations, including reliance on key supplier relationships;

- the impacts of, and associated responses to, the COVID-19 pandemic on Campbell’s and/or Sovos Brands’ business, suppliers, customers, consumers and employees;

- the risks related to the effectiveness of Campbell’s hedging activities and Campbell’s ability to respond to volatility in commodity prices;

- Campbell’s ability to manage changes to its organizational structure and/or business processes, including selling, distribution, manufacturing and information management systems or processes; changes in consumer demand for Campbell’s and Sovos Brands’ products and favorable perception of such brands;

- changing inventory management practices by certain of Campbell’s and Sovos Brands’ key customers;

- a changing customer landscape, with value and e-commerce retailers expanding their market presence, while certain of the Campbell’s key customers maintain significance to Campbell’s business; product quality and safety issues, including recalls and product liabilities;

- the possible disruption to the independent contractor distribution models used by certain of Campbell’s businesses, including as a result of litigation or regulatory actions affecting their independent contractor classification;

- the uncertainties of litigation and regulatory actions against Campbell’s or Sovos Brands;

- the costs, disruption and diversion of management’s attention associated with activist investors;

- a disruption, failure or security breach of Campbell’s, Campbell’s vendors’, Sovos Brands’ or Sovos Brands’ vendors information technology systems, including ransomware attacks;

- impairment to goodwill or other intangible assets;

- Campbell’s and Sovos Brands’ ability to protect their respective intellectual property rights;

- increased liabilities and costs related to Campbell’s defined benefit pension plans;

- Campbell’s and Sovos Brands’ ability to attract and retain key talent;

- goals and initiatives related to, and the impacts of, climate change, including weather-related events;

- negative changes and volatility in financial and credit markets, deteriorating economic conditions and other external factors, including changes in laws and regulations; and unforeseen business disruptions or other impacts due to political instability, civil disobedience, terrorism, armed hostilities (including the ongoing conflict between Russia and Ukraine), extreme weather conditions, natural disasters, other pandemics or other calamities

Additional information concerning these and other risk factors can be found in Campbell’s and Sovos Brands filings with the SEC and available through the SEC’s Electronic Data Gathering and Analysis Retrieval system at http://www.sec.gov, including Campbell’s and Sovos Brands’ most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

The discussion of uncertainties is by no means exhaustive but is designed to highlight important factors that may impact the outlook of Campbell and Sovos Brands. Campbell and Sovos Brands each disclaim any obligation or intent to update the forward-looking statements in order to reflect events or circumstances after the date of this release except as required by law.

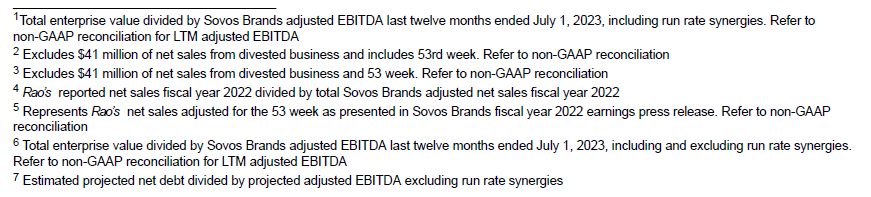

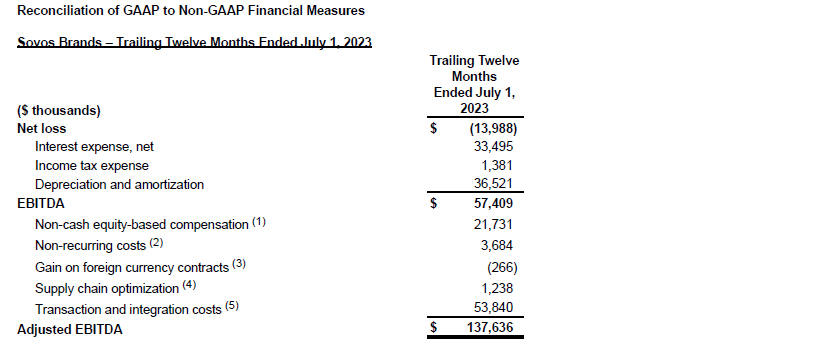

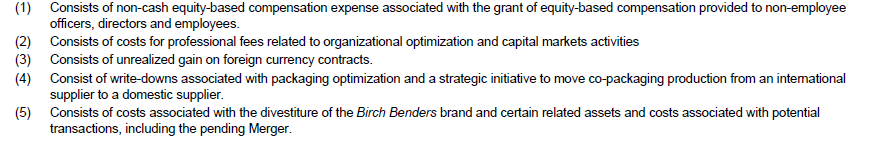

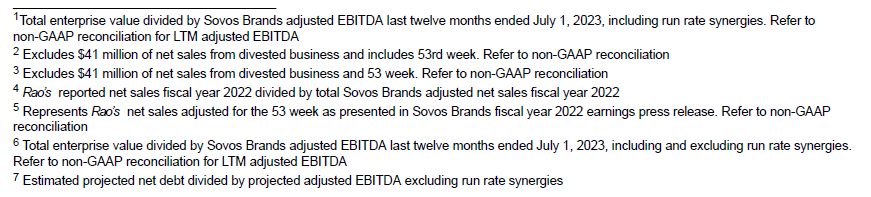

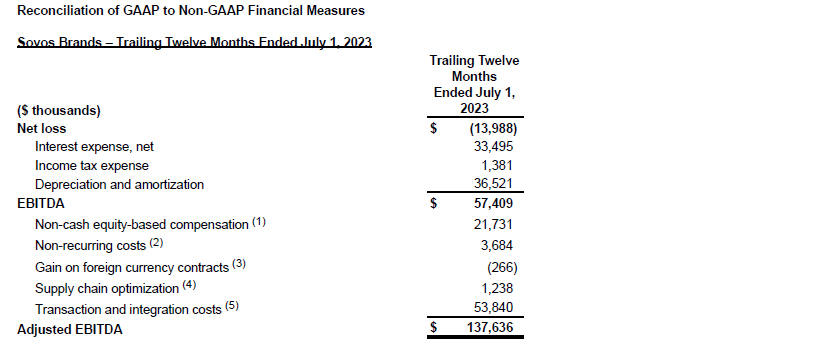

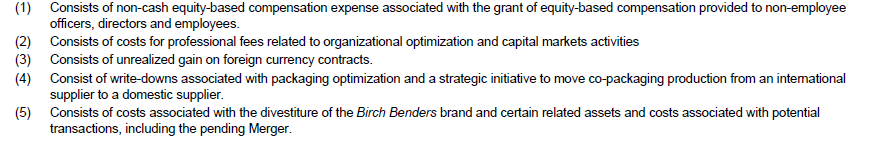

Non-GAAP Financial Measures

This press release includes measures that are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Campbell uses Sovos Brands Adjusted EBITDA and organic net sales, which are non-GAAP measures, in this press release. For each of these non-GAAP financial measures, we have included below a reconciliation of the differences between the non-GAAP measure and the most comparable GAAP measure. These non-GAAP measures should be viewed in addition to, and not in lieu of, the comparable GAAP measure.

(1) Reflects Net Sales for the Birch Benders brand generated in the 53 weeks ended December 31, 2022.

(2) Reflects Net Sales generated in the 53rd week by the Rao’s , Michael Angelo’s and noosa brands.

(3) Sovos Brands Organic Net Sales and Organic Net Sales growth are defined as Reported Net Sales or Reported Net Sales growth excluding, when they occur, the impact of a 53rd week of shipments, acquisitions, and divestitures.

Campbell discusses projected leverage in this press release only in relation to management’s expectations of the future effect of the Sovos Brands transaction and has not provided a reconciliation of these forward-looking projected leverage expectations to the mostly directly comparable GAAP measure due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments

that could be made for actuarial gains or losses on pension and postretirement plans because these impacts are dependent on future changes in market conditions, transaction and integration costs and other charges reflected in Campbell’s reconciliations of historical numbers, the amounts of which, based on historical experience, could be significant.