As a partnership-led private equity firm, we know the value of collaboration

A green revolution in last mile parcel delivery

In 2015, serial entrepreneur and ex-parcel delivery driver, Rafał Brzoska, was seeking funding for the innovative parcel delivery company he’d built from scratch. He realized that it was better for the environment and more convenient for consumers if trucks delivered hundreds of parcels to one location, where consumers could pick them up from hi-tech lockers at their leisure.

“Advent trusted me to make the right calls. Some funds stifle their management, but Advent gave me the tools and let me get on with the job of executing the plan. It was an intensive partnership with some robust discussions, but it was a true partnership and I couldn’t have got to where I am so quickly without them.”

Rafał Brzoska

CEO, InPost

“We believed that with the right focus and resources, InPost, under the leadership of an exceptional entrepreneur like Rafał, had the potential to disrupt not only Poland but also across Europe in an industry ripe for innovation.”

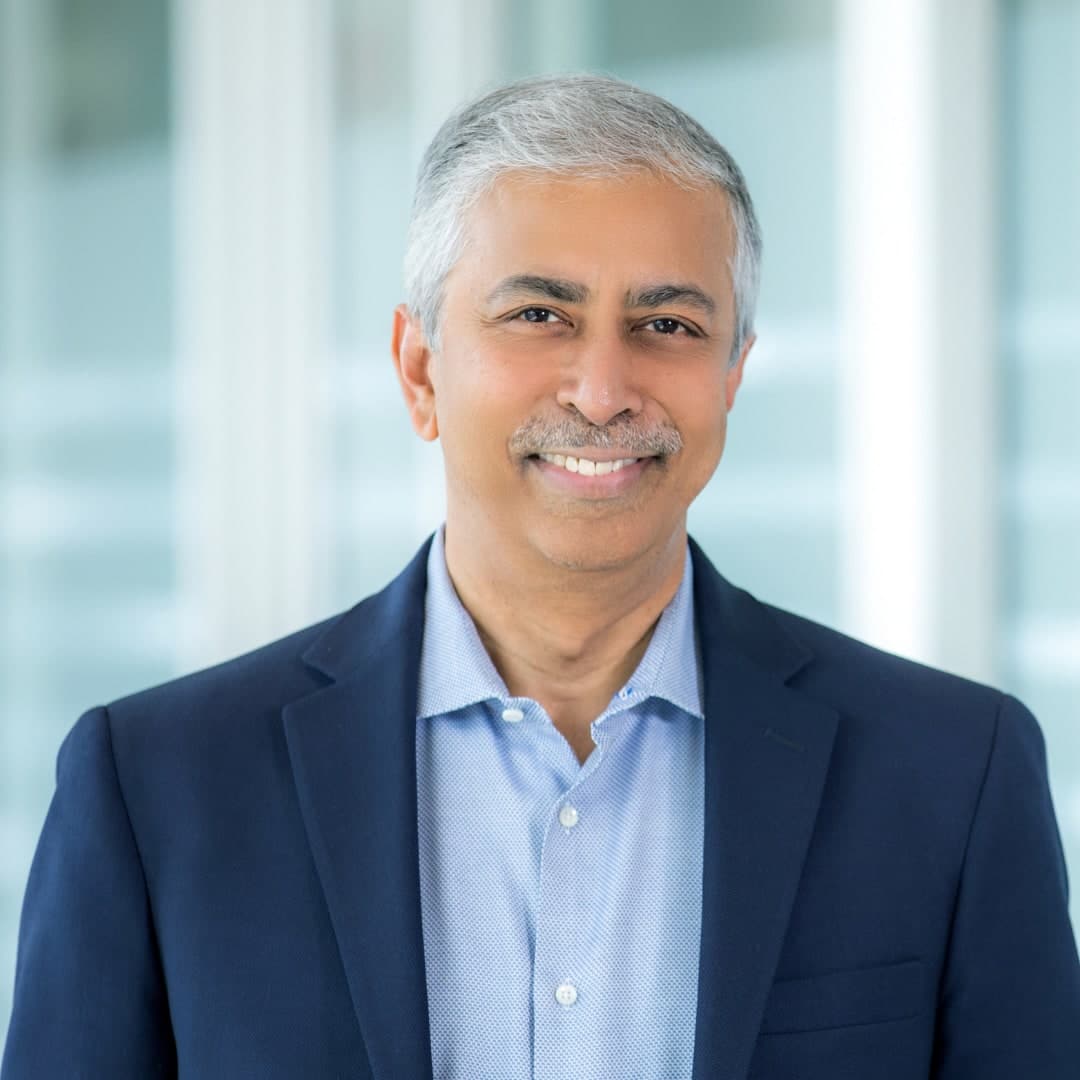

Ranjan Sen

Managing Partner, Advent and InPost board member

Going back to its roots

Rapid expansion had taken a financial toll on the company, and the existing locker network was spread too thinly. Working alongside Brzoska, we hatched a plan to refocus on its two strongest markets: Poland and the UK. We then invested heavily to put the consumer at the center of an expanded locker network.

Unlocking further growth

Together with Advent’s Portfolio Support Group, an enhanced management team set about driving operational change, improving depot efficiency by 80% within six months. Then, when Covid-19 hit, the team quickly advertised the safety virtues of InPost’s system. It partnered with retailers to get goods to consumers quickly and safely during the pandemic, leading consumers to flock to the business.

Transforming the logistics sub-sector

When we acquired InPost in 2017, it was heavily financially stressed. After taking the company private, we worked with management to reorient the business. During Advent’s ownership, InPost increased growth in parcel and locker volume 8x and ~6x, respectively, from 2016 to 2020.

The road to innovation

CCC is a leading vertical market software platform, harnessing deep industry expertise, data, and artificial intelligence (AI) to drive a more connected ecosystem in the auto collision repair industry.

"We have worked with multiple private equity investors over the years. What Advent brings to the table is tremendous capability, hard work, humility, and depth of understanding."

Githesh Ramamurthy

Chairman and CEO, CCC

"We knew CCC had built an incredible market position which could be further propelled with the combination of our resources and thought partnership."

Eric Wei

Managing Director, Advent

Working hand-in-hand with management

Advent partnered with a visionary management team to continue to build out a best-in-class suite of software solutions for insurance carriers, collision repair shops, and automotive manufacturers.

Going the extra mile

In partnership with management, Advent prioritized strengthening the CCC network of customers and invested in a variety of new product initiatives to create a truly end-to-end software platform.

"This was a complex transaction that brought together Advent’s global experience in software with our history of working with banks on non-core subsidiaries. We are proud of the successful transformation of the business into a European standalone software champion."

Jeff Paduch

Managing Partner, Advent

"Our partnership with Advent has rapidly advanced our evolution into one of Europe’s most trusted SaaS providers, launching us on an exponential growth trajectory. We are grateful for their expertise and support, which have been crucial to our development and laid the foundation for further success."

Harry Thomsen

CEO, Aareon

A hidden asset with great potential

Advent identified Aareon as a potential standout software company long before our investment in October 2020. When Aareal reached out for a partner, Advent was a natural fit due to our experience in software and presence in Germany. This gave us credibility in a complex initial investment as minority shareholders in the development of Aareon as a standalone entity.

The team to get the job done

One of the most important steps we took to transform Aareon’s growth was to support an enhanced management team and shift the culture from a bank subsidiary to that of a standalone, customer-focused software champion.

A new chapter

Advent aims to work with companies where there is the possibility to cultivate long-term growth through various value-creation levers. Our investment in Aareon led to an increase in properties managed to 19 million from 10 million. We’re excited to continue supporting Aareon on its journey to becoming a EUR €1 billion revenue company.

Breathing new life into Bharat Serums and Vaccines

At Bharat Serums and Vaccines (BSV), Advent identified a company with the potential to become a domestic and international provider of health and fertility products for millions of women.

BSV is a true case of business building. Advent executed our value creation plan, and it’s very satisfying that a large strategic buyer has now acquired the company because it can see its growth potential.

Pankaj Patwari

Managing Director, Advent

In partnership with Advent, we created one of the largest pharmaceutical companies in India, with a culture of innovation and an exciting pipeline of products with global appeal.

Sanjiv Navangul

Managing Director and CEO, BSV

Planning a path to recovery

Advent developed a plan to realize the full potential of BSV based on four key themes: build a new management and governance structure; commercialize the product pipeline; pursue international expansion; and revamp the domestic go-to-market strategy.

Breathing new life into BSV

Advent provided extensive support to the management team, overhauled the operations and pricing strategy, and refocused research and development on building a best-in-class pipeline across BSV’s three core therapy areas throughout five key markets.

A company reborn

When Advent sold the business, it had been transformed into a champion in women’s health. Just as importantly, we invested heavily to build a better line of treatments to benefit millions of women in India and internationally. Today, BSV remains committed to widening access and availability of innovative treatments for women while delivering positive patient outcomes.

Making investing simpler with Easynvest

During our partnership with Easynvest, now known as NuInvest, we identified an opportunity to evolve a traditional stockbroker to a fintech business focused on making investing simpler for Brazilians.

“With the support of Advent, we created and introduced a new platform for fee-free equity trading that emphasized simplicity.”

Fernando Miranda

Former CEO, Easynvest

“Easynvest could have created offline services, but it wanted to stay true to its digital roots. This approach paid off as we quadrupled the number of users during our partnership with the company.”

Brenno Raiko

Managing Director, Advent

Out with the old, in with the new

Advent invested in Easynvest in 2018 and seized an opportunity to change the way Brazilians think about investing by supporting a user-friendly open loop investment platform. Our prior experience in the business & financial services sector enabled us to support Easynvest’s strategy and implement governance structures to support its next phase of evolution.

The digital revolution

Throughout our partnership, Easynvest was equipped with the resources to further invest in its digital platform. These efforts included developing an online marketplace to allow customers to invest in a range of financial instruments and enhancing the company’s online platform to provide a seamless user experience.

Investing in the future

A competitive exit process involved strategic players and financial sponsors that were drawn to Easynvest due to its functionality and ability to simplify investing. Recognizing that scale was crucial for ongoing success, Advent determined that a strategic sale was the best next step for Easynvest to continue expanding its customer base.

Going big in Brazil

Looking for an opportunity to expand into the Brazilian groceries sector, in 2018 Advent signed a partnership agreement with Walmart to acquire 80% of the retailer’s Brazilian business. We improved operations, rationalized locations, and reimagined the e-commerce platform.

"Advent is proud of the impact we’ve had in helping return Grupo Big to growth by focusing on a local offering and selling great products at great prices to consumers across Brazil."

Wilson Rosa

Managing Director, Advent

"The scale of the task was enormous, but Advent brought real focus and resources to help turn this company around. This was a true partnership during a very difficult time for Brazilian retail."

Luiz Fazzio

CEO, Grupo Big

The right partnership

Walmart Brazil’s 438 stores, 188 drugstores, 14 gas stations, and e-commerce portal offered opportunities to increase efficiencies and turnover. With our deep consumer expertise and long-established presence in Brazil, Advent joined Walmart to take the company forward.

Adding some Brazilian flavor

Tailoring the portfolio to the nuances of the Brazilian consumer sector was the key to success. Grupo Big repurposed, rebranded, and refurbished stores to improve cultural resonance.

The proof is in the pudding

When Grupo Big was acquired by Carrefour Brazil in 2022, the company had one of the best management teams in the business, a rejuvenated store portfolio, and optimal operations.

A thirst for growth

Culligan had a strong brand in the US that had drifted strategically under the ownership of a succession of conglomerates. We saw the potential to build a champion in global, consumer drinking water services, with an exceptional CEO, Scott Clawson.

"Advent played a crucial role in defining our strategy and driving programmatic global M&A. We could not have gone as far or fast without their resources and network. This is what transformational partnerships should look like."

Scott Clawson

CEO, Culligan International

"Our collaboration with Culligan typifies the Advent approach: we identified a fundamentally sound business that lacked clear focus and aligned it behind an ambitious plan for global leadership."

Stephen Hoffmeister

Managing Director, Advent

Putting in the plumbing for global growth

We developed a plan with two core elements: turbocharge organic growth with investments in new products, branding, and digital marketing, as well as to acquire the top players in premium filtered water in strategically attractive global markets.

Turning on the tap

We took the best ideas, brands, and technology from each market and offered it to consumers across the global platform. We then prioritized innovation, internal product development, and research and development to further enhance our technological leadership.

Raising a glass to future success

Our conviction in the team’s ability to deliver an incredibly ambitious growth plan was rewarded, with USD $1 billion in sales uplift from global acquisitions during Advent’s involvement. We’re excited to continue the partnership as Culligan continues its journey.

A dream come true: establishing AI Dream in China

We identified an opportunity to establish and scale a premium mattress and sleep products platform in China.

"Advent’s investment in AI Dream allowed us to be one of the fastest-growing consumer brands in China."

Edward Wu

CEO, AI Dream

"The team’s expertise in the sector set us apart... Our knowledge of the sector demonstrated the value we could bring, which enabled us to establish a trust-based partnership."

Andrew Li

Managing Director, Advent

Identifying potential

Advent created a leader in the China mattress market across online and offline channels, as well as via cross-selling.

Springing into action

Advent marketed the brand to establish a differentiated position and build a strong team to outperform in a distribution-focused market while repositioning the company from a single-branded business to a multi-brand premium mattress platform.

Turning a dream into reality

AI Dream’s footprint increased from 300 branded stores to more than 2,300 branded stores, in over 600 cities, across mainland China and Hong Kong.