Opportunity

Disrupt the concentrated Brazilian finance market, which was dominated by traditional banks offering closed loop investment platforms with high fees.

Approach

Improve the user experience and grow the customer base with targeted marketing. Operate an open loop investment platform with low fees, allowing Brazilians to invest with ease.

Impact

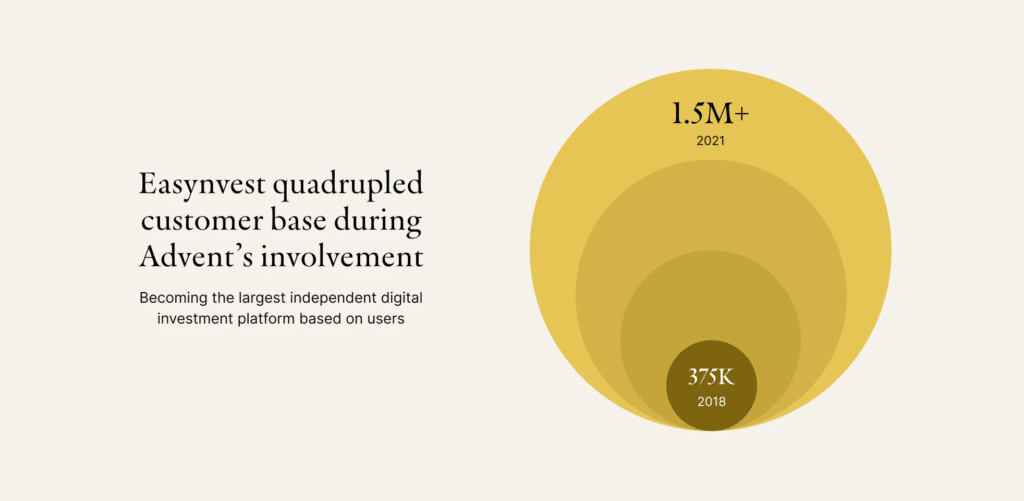

Quadrupled customer base to 1.5 million customers during Advent’s ownership, becoming the largest independent digital investment platform based on users.

Out with the old, in with the new

For many years, Brazil had been dominated by the same traditional banks, leaving customers with little choice and often a poor user experience due to the lack of competition. Most financial products were only available offline, forcing many to travel to branches near and far to explore complex financial products with limited guidance from banks. Consequently, this meant many Brazilians had an untapped curiosity for investing in the absence of a simple approach. These banks offered only closed-loop investment platforms, typically providing in-house investment products to clients at higher fees. These banks offered only closed-loop investment platforms, typically providing in-house investment products to clients at higher fees, excluding many people from investing and limiting investment alternatives for clients. The ecosystem was ripe for disruption.

Advent seized an opportunity to change the way Brazilians think about investing by supporting a user-friendly open loop investment platform. Easynvest is a platform that allows users to invest in just three clicks with no brokerage fees for most of its products. It offers a large number of investment options for diversifying portfolios and provides educational tips to simplify the investing process. Originally founded in 1968 as Título Corretora de Valores, it became one of the first brokers in Brazil to offer online share trading through its home broker service in 1999. The seismic changes began in the 1990s with advancements in technology, leading to the pioneering launch of Easynvest as one of the first online platforms for buying and selling shares in Brazil at that time.

Through Advent’s ongoing diligence in the wealth and asset management space locally and the collaboration with our US colleagues who had developed a ‘sourcing cell,’ a specialist Advent team in this space, we were able to find Easynvest, and we invested in 2018. The knowledge of the space both locally and globally put us in a strong position to advise Easynvest as it pursued growth and implemented governance structures to support its next phase of evolution.

“With the support of Advent, we created and introduced a new platform for fee-free equity trading that emphasized simplicity. This platform had a significant impact on the market, as it provided an accessible way for the average person to trade equities for the first time.”

Fernando Miranda

Former CEO, Easynvest

Financial supermarket

A key focus was making investing accessible to Brazilians. We prioritized including educational content to increase usability and equip first-time investors with the tools needed to make smart self-directed investments.

In tandem with the founders and management team, Advent set out to create a marketplace that enables individuals to invest in a wide range of financial instruments, including government bonds, fixed-income securities, and mutual funds, as well as to trade in equities, options, and futures. We shared a common goal: to attract new clients and create a best-in-class customer experience.

To achieve our shared goal, Easynvest invested significantly in a structured go-to-market approach to attract new clients and implemented a robust marketing process to speed up customer acquisition and enhance the customer activation process. Easynvest’s zero fee platform for the vast majority of the products was crucial in attracting and retaining customers. It was crucial to maintain and expand a large customer base in order to attract issuers. These issuers viewed Easynvest’s platform as a key channel to raise funds from retail investors, diversifying away from typically more expensive and volatile institutional funding sources. This created a recurring flywheel effect.

The digital revolution

Easynvest was built as a purely digital platform, operating through its website and an app. The company had already started making improvements to the website and its broader digital infrastructure, and with Advent’s support, it was able to take the platform to new heights. Our goal was to disrupt traditional banks that were branch-oriented and had tech difficulties with their old legacy systems. Advent’s Portfolio Support Group (PSG) helped Easynvest enhance its existing digital marketing team, which was focused on customer acquisition. In collaboration with the PSG team, the marketing team created external benchmarks and scaled the team to make it stronger.

Our partnership also enabled Easynvest to invest in technology and upgrade its systems by launching new versions of its app and website. We worked on microservices, breaking down the monolithic platform into many different services, which made it more manageable and faster to launch updates.

Easynvest was the main purely digital investing platform in Brazil. Other peers were operating hybrid models, typically with independent sales agents (agentes autônomos), or were traditional brick-and-mortar banks. A key part of the puzzle was becoming the best digital provider, as this was Easynvest’s only vertical.

“Easynvest could have created offline services, but it wanted to stay true to its digital roots. This approach paid off as we quadrupled the number of users during our partnership with the company,” said Brenno Raiko, a Managing Director at Advent.

“Advent partnered with the founders and management team and began the journey together with a shared goal of creating an accessible and simple platform with a growing customer base.”

Mario Malta

Managing Director, Advent

As the business grew, competitors began to take notice and enhance their own customer experiences. The market became more competitive, but even with this shift, Easynvest remained a standout leader in the digital space. The company’s expanding customer base was a significant competitive advantage.

The focus of the value creation plan was on acquiring customers, improving customer service, and strengthening Easynvest’s digital infrastructure. In December 2020, to further the value creation plan Easynvest completed the acquisition of Vérios, a robo-advisory company in Brazil. Vérios automates all operational aspects of managing individual portfolios and simplifies investing.

Investing in the future

The educational platform the team had developed proved to be valuable upon exit, serving as a strong attraction for both traditional and non-traditional banks due to its functionality and ability to simplify investing.

Easynvest was considering another capital raise process when several strategic players approached the company for a full sale. The competitive exit process attracted interest from both strategic players and financial sponsors, including incumbent banks observing market disruption and digital banks looking to enter the investing vertical. These bidders sought to enhance their offerings in digital financial investing by acquiring Easynvest, viewing it as a leader in the space. Recognizing that scale was crucial for continued success, we decided that a strategic sale was the best next step for the business to continue expanding its customer base.